Ethical considerations of using AI for cryptocurrency price manipulation. are paramount as artificial intelligence offers unprecedented opportunities for market manipulation. The ability of AI to process vast datasets, identify patterns, and execute trades at speeds far exceeding human capabilities presents a significant threat to market integrity. This exploration delves into the technical methods, legal ramifications, ethical dilemmas, and potential societal consequences of AI-driven price manipulation in the volatile world of cryptocurrencies, offering a comprehensive analysis of this emerging challenge.

From sophisticated algorithms designed to exploit market inefficiencies to the potential for coordinated attacks across multiple exchanges, the scale and impact of AI-driven manipulation could be devastating. Understanding the vulnerabilities, developing effective countermeasures, and establishing robust regulatory frameworks are crucial to ensuring fair and transparent cryptocurrency markets. This analysis examines the roles of AI developers, exchanges, and regulators in mitigating this risk, and proposes solutions for creating a more secure and ethical cryptocurrency ecosystem.

Defining AI-driven Cryptocurrency Price Manipulation: Ethical Considerations Of Using AI For Cryptocurrency Price Manipulation.

AI-driven cryptocurrency price manipulation refers to the use of artificial intelligence algorithms and machine learning techniques to artificially inflate or deflate the price of cryptocurrencies for illicit profit. This differs from traditional market manipulation, which often relies on human actors and less sophisticated strategies. The sophistication and speed of AI algorithms allow for manipulation on a scale and with a complexity previously unimaginable.AI can be employed in various ways to manipulate cryptocurrency markets.

These methods leverage the decentralized and often less regulated nature of these markets, exploiting vulnerabilities in trading mechanisms and exploiting human behavioral biases.

Methods of AI-Driven Cryptocurrency Price Manipulation

AI algorithms can be trained to identify and exploit market inefficiencies, predict price movements with greater accuracy than traditional methods, and execute trades at speeds far exceeding human capabilities. This allows for the creation of sophisticated trading bots capable of coordinating large-scale buying or selling pressure, artificially influencing price trends. Specific methods include:

- Spoofing: AI can place large buy or sell orders to create a false impression of market demand, luring other traders into buying or selling at artificially inflated or deflated prices. The AI then cancels these orders before they are executed, profiting from the price swing.

- Wash Trading: AI can execute trades between multiple accounts controlled by the same entity, creating artificial volume and giving the false impression of high trading activity and demand, thereby influencing price.

- Pump and Dump Schemes: AI can be used to coordinate a coordinated campaign across multiple social media platforms and forums to generate hype around a particular cryptocurrency, artificially inflating its price. Once the price reaches a peak, the AI then executes a large sell-off, resulting in a significant price drop and substantial profit for the manipulators.

- Arbitrage Exploitation: AI can rapidly identify and exploit price discrepancies across different cryptocurrency exchanges, buying low on one exchange and selling high on another, amplifying price fluctuations.

Technical Infrastructure for AI-Driven Manipulation

The infrastructure required for effective AI-driven manipulation is multifaceted and requires significant resources. It necessitates access to substantial computing power for training and running sophisticated algorithms, high-bandwidth connections for rapid order execution, and a network of multiple trading accounts to obscure the manipulation. Further, access to vast datasets of historical market data is crucial for training the AI models to accurately predict price movements.

- High-Performance Computing (HPC): Powerful servers and GPUs are essential for training complex AI models and executing high-frequency trading strategies. Cloud computing services provide scalable resources for this purpose.

- Advanced Algorithms: Sophisticated machine learning algorithms, such as reinforcement learning and deep learning, are needed to develop predictive models and execute complex trading strategies.

- Multiple Trading Accounts: A network of accounts across different exchanges is crucial for concealing the manipulative activity and distributing the trading volume.

- API Access: Direct access to cryptocurrency exchange APIs is required for automated trading and high-speed order execution.

Potential Scale and Impact of AI-Driven Manipulation

The potential scale and impact of AI-driven cryptocurrency price manipulation are substantial. The speed and sophistication of AI algorithms allow for manipulation on a scale far exceeding human capabilities. This can lead to significant financial losses for unsuspecting traders, erode trust in the cryptocurrency market, and potentially destabilize the entire financial ecosystem. The decentralized and relatively unregulated nature of the cryptocurrency market makes it particularly vulnerable to such attacks.

The potential for large-scale coordinated manipulation, amplified by the use of social media and other communication channels, poses a significant threat. For example, a coordinated AI-driven pump-and-dump scheme could potentially manipulate the price of a smaller-cap cryptocurrency, resulting in millions of dollars in losses for retail investors.

Market Integrity and Fair Trading

AI-driven cryptocurrency price manipulation poses a significant threat to the integrity and fairness of cryptocurrency markets. The decentralized nature of these markets, while offering certain advantages, also creates vulnerabilities that sophisticated AI algorithms can exploit, leading to distorted price signals and unfair trading outcomes for unsuspecting participants. This undermines investor confidence and can ultimately destabilize the entire ecosystem.AI-driven price manipulation severely undermines market integrity by distorting price discovery.

In healthy markets, prices reflect the collective wisdom of buyers and sellers, accurately representing the underlying value of an asset. However, AI algorithms can artificially inflate or deflate prices through coordinated buying and selling, creating a false sense of market demand or scarcity. This manipulation prevents genuine price discovery, leading to inefficient allocation of capital and potentially harming legitimate investors who rely on accurate market signals for investment decisions.

The lack of transparency surrounding these AI-driven actions further exacerbates the problem, making it difficult to identify and counteract manipulative activities.

Comparison of AI and Traditional Market Manipulation

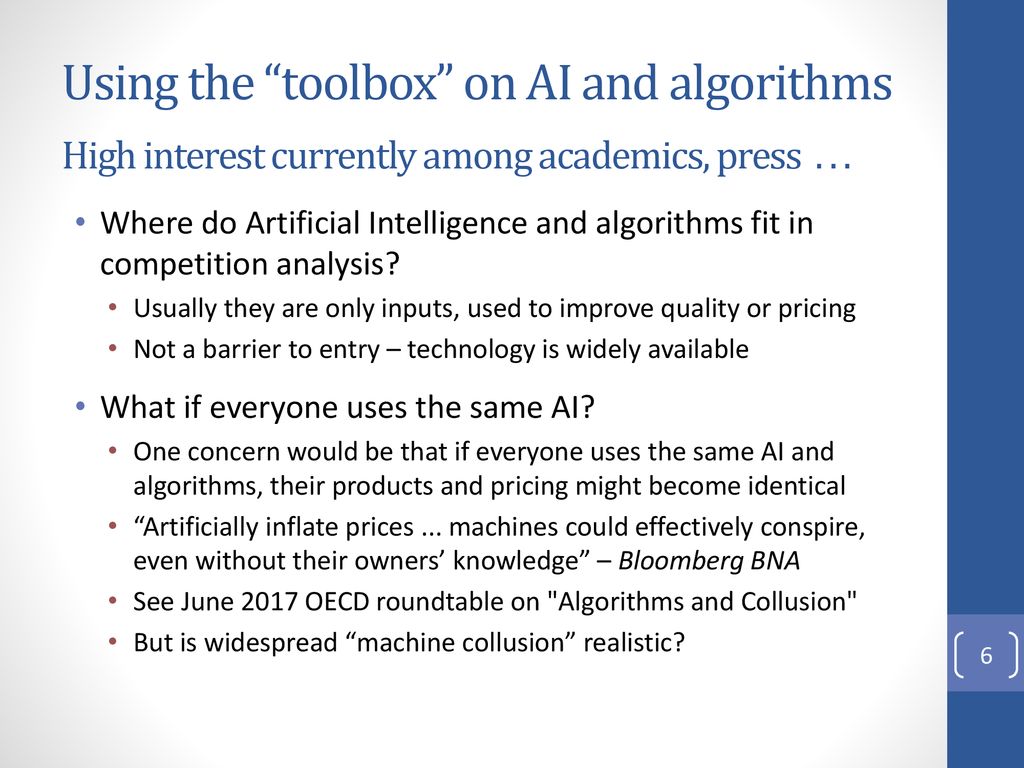

AI-driven manipulation differs from traditional methods in its scale, speed, and sophistication. Traditional methods often involve coordinated actions by a small group of individuals, relying on manual trading and potentially relying on insider information or market rumors. AI, however, can automate these processes at an unprecedented scale, executing thousands of trades per second based on complex algorithms and real-time market data analysis.

This allows for far more rapid and impactful manipulation than human-driven efforts. Furthermore, AI can analyze vast datasets to identify subtle market vulnerabilities and exploit them in ways that are difficult for human traders to detect. For example, a traditional “pump and dump” scheme might involve a coordinated effort to spread false information about a cryptocurrency, driving up its price before selling off large holdings.

In contrast, an AI-driven scheme could use sophisticated algorithms to identify and exploit short-term price fluctuations, amplifying them to create artificial volatility and profit from the resulting price swings, often without the need for disseminating false information.

Exacerbation of Existing Market Vulnerabilities

AI has the potential to exacerbate existing vulnerabilities within cryptocurrency markets. The inherent volatility of cryptocurrencies, coupled with the relatively thin liquidity of some markets, makes them particularly susceptible to manipulation. AI algorithms can exploit these weaknesses by amplifying existing price swings, creating cascading effects that can lead to significant market instability. For instance, a sudden influx of AI-driven trades, designed to artificially inflate the price of a cryptocurrency, can trigger a cascade of stop-loss orders from other investors, further exacerbating the price increase (or decrease, depending on the manipulation strategy).

This creates a self-reinforcing cycle that can lead to significant losses for unsuspecting investors and destabilize the overall market. The lack of robust regulatory oversight in many cryptocurrency markets further compounds this vulnerability, providing a fertile ground for sophisticated AI-driven manipulation schemes to thrive.

Legal and Regulatory Frameworks

The burgeoning cryptocurrency market, characterized by its decentralized nature and rapid technological advancements, presents unique challenges for regulators seeking to maintain market integrity and prevent manipulation. Existing legal frameworks, largely designed for traditional financial markets, often struggle to adequately address the complexities of AI-driven price manipulation in the crypto space. This section examines current regulatory efforts, their limitations, and proposes a hypothetical framework specifically tailored to combat AI-driven manipulation.Existing legal frameworks addressing market manipulation in the cryptocurrency space are fragmented and vary significantly across jurisdictions.

Many countries treat cryptocurrencies as commodities, applying existing commodity trading regulations. Others are developing specific crypto-asset regulations, often focusing on anti-money laundering (AML) and know-your-customer (KYC) compliance, but with less emphasis on sophisticated trading practices like AI-driven manipulation. The effectiveness of these regulations in preventing AI-driven manipulation is currently limited due to the decentralized nature of cryptocurrencies, the global reach of crypto exchanges, and the rapid evolution of AI technologies.

Enforcement is often hampered by jurisdictional challenges and the difficulty in tracing the origin and actions of sophisticated AI-driven trading bots.

Existing Regulatory Approaches and Their Limitations

Current regulations, while aiming to maintain fair markets, often fall short in effectively addressing the subtle and sophisticated nature of AI-driven manipulation. For example, laws prohibiting market manipulation typically focus on identifiable individuals or entities engaging in manipulative activities. However, AI-driven manipulation often involves autonomous algorithms operating across multiple exchanges, making it difficult to pinpoint a single responsible party.

Furthermore, the speed and scale at which AI algorithms can execute trades often outpaces the capabilities of human regulators to detect and respond to manipulative activity in real-time. The lack of a unified global regulatory framework further exacerbates the problem, allowing manipulative actors to exploit regulatory gaps across different jurisdictions. The absence of clear definitions for AI-driven manipulation in existing legislation also creates ambiguity, making prosecution difficult.

A Hypothetical Regulatory Framework for AI-Driven Cryptocurrency Price Manipulation

To effectively address AI-driven cryptocurrency price manipulation, a comprehensive regulatory framework is needed. This framework should encompass clear definitions, robust detection mechanisms, and effective enforcement measures. The following table Artikels a hypothetical framework:

| Regulatory Body | Specific Prohibition | Enforcement Mechanism | Penalties |

|---|---|---|---|

| International Cryptocurrency Regulatory Authority (ICRA) – a hypothetical global body | Use of AI algorithms to artificially inflate or deflate cryptocurrency prices through coordinated trading activity across multiple exchanges. This includes, but is not limited to, wash trading, spoofing, layering, and other manipulative tactics employed by AI. | Real-time market surveillance using advanced AI detection systems, collaboration with exchanges to identify and flag suspicious trading patterns, and investigation of flagged activities. | Significant fines, temporary or permanent trading bans for individuals and entities involved, and potential criminal charges for fraudulent activities. Penalties should be proportionate to the scale and impact of the manipulation. |

| National Financial Regulators (e.g., SEC, FCA, etc.) | Operation of AI-powered trading bots without proper registration and disclosure, failure to implement adequate risk management controls to prevent manipulative behavior by AI systems. | Audits of AI trading systems, investigations into suspicious trading patterns, and enforcement of registration and disclosure requirements. | Fines, cease-and-desist orders, and potential legal action for violations of registration and disclosure requirements. |

This hypothetical framework aims to establish clear lines of responsibility and accountability, enhancing the capacity to detect and prevent AI-driven manipulation in the cryptocurrency market. The creation of an international regulatory body is crucial to address the global nature of cryptocurrency trading and to ensure consistent enforcement across jurisdictions. The use of advanced AI detection systems by regulatory bodies would allow for proactive identification of suspicious trading patterns before they significantly impact market integrity.

Ethical Implications for Investors

The undetected use of AI for cryptocurrency price manipulation poses significant ethical challenges for investors, undermining the principles of fair and transparent markets. The potential for substantial financial losses, coupled with the erosion of trust in the cryptocurrency ecosystem, creates a complex ethical landscape demanding careful consideration. Investors rely on market integrity to make informed decisions, and AI-driven manipulation directly contravenes this fundamental expectation.AI-driven manipulation can lead to significant financial losses for investors who are unaware of the artificial inflation or deflation of asset prices.

For example, a sophisticated AI bot could artificially inflate the price of a cryptocurrency, enticing unsuspecting investors to buy at inflated prices. Once the manipulation is complete, the price could plummet, resulting in substantial losses for these investors. This not only represents a direct financial harm but also erodes trust in the market mechanisms and the integrity of the digital asset itself.

The lack of transparency inherent in such manipulation makes it difficult for investors to identify and protect themselves against these predatory practices.

Responsibility of AI Developers and Cryptocurrency Exchanges

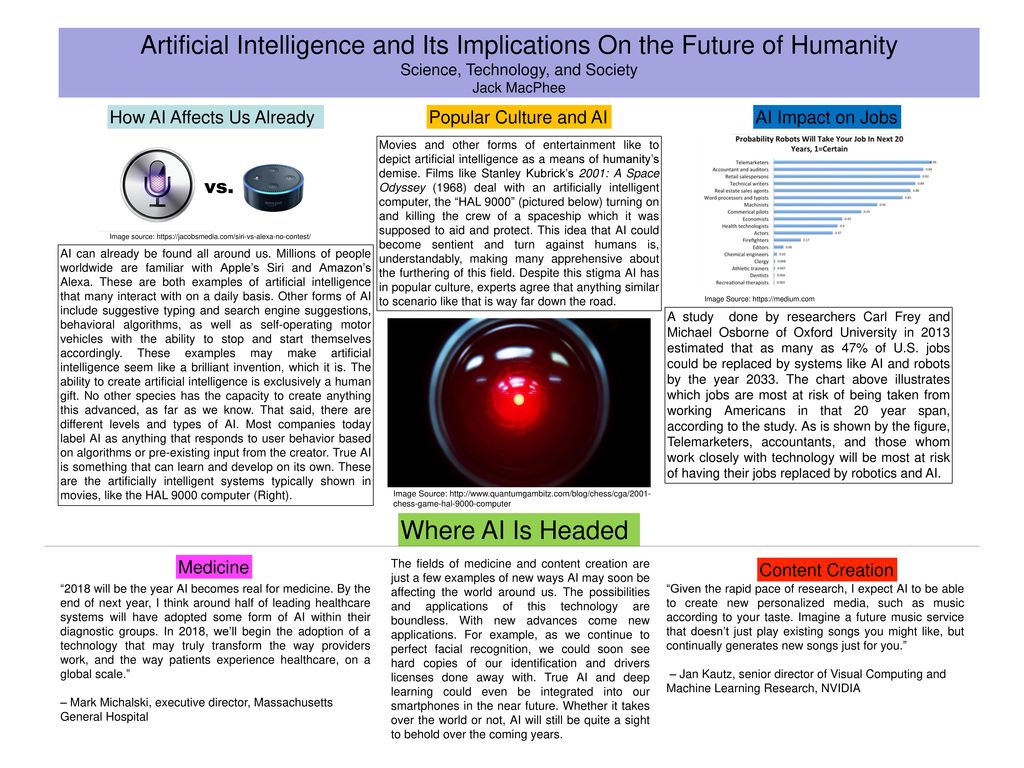

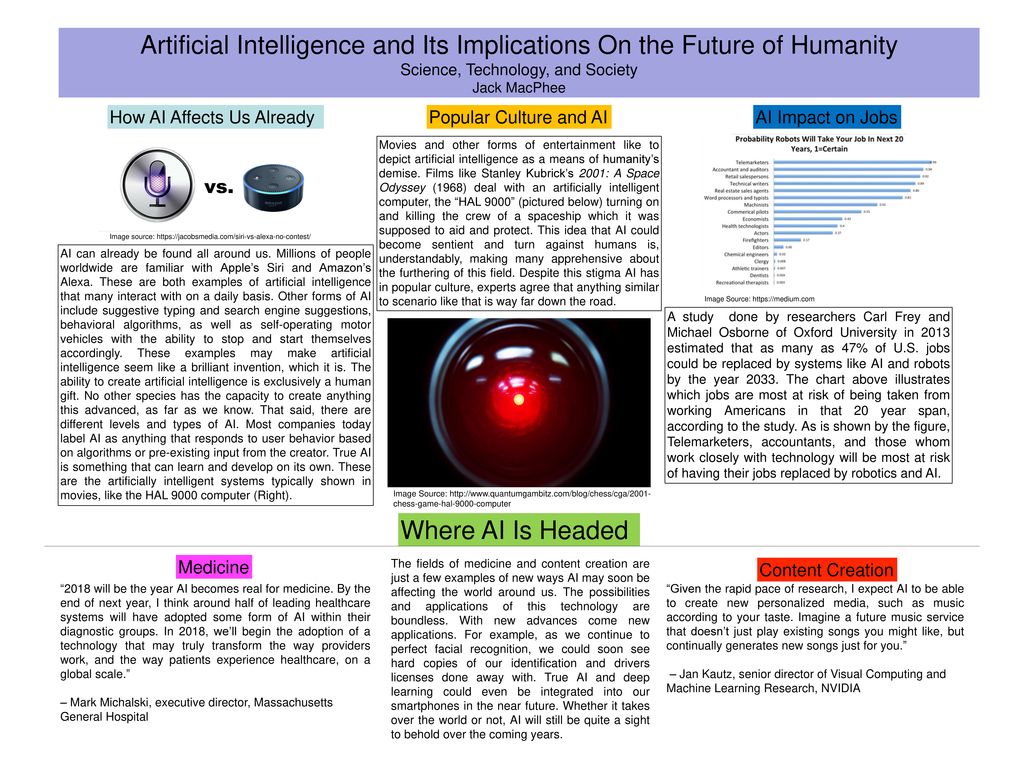

AI developers bear a significant ethical responsibility to ensure their creations are not used for malicious purposes. This involves incorporating robust safeguards into the algorithms themselves, limiting their capabilities to prevent manipulation, and actively monitoring their use. Furthermore, developers should prioritize transparency in the design and functionality of their AI systems, enabling greater scrutiny and reducing the potential for misuse.

Cryptocurrency exchanges also play a crucial role. They must implement stringent monitoring systems to detect unusual trading patterns indicative of AI-driven manipulation. This might involve employing their own AI systems to analyze trading data, looking for anomalies that could suggest manipulation. Proactive measures, such as enhanced Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, could also help identify and prevent suspicious activities.

Stronger collaboration between developers and exchanges is crucial in establishing a robust defense against AI-driven market manipulation. The failure to implement these measures contributes to a climate of ethical negligence, directly impacting investor trust and market stability.

Impact on Investor Confidence and Market Participation

The undetected use of AI for cryptocurrency price manipulation significantly erodes investor confidence. When investors perceive a lack of fairness and transparency, they are less likely to participate in the market. This can lead to reduced liquidity and market volatility, making it harder for legitimate businesses and investors to operate. A decline in investor confidence can also trigger a negative feedback loop, where fewer investors lead to decreased liquidity, increased volatility, and further loss of confidence.

Consider, for instance, the impact of a large-scale AI-driven manipulation event being exposed. The resulting loss of trust could cause a significant market crash, with potentially devastating consequences for both individual investors and the broader cryptocurrency ecosystem. The long-term impact on market participation could be profound, hindering the growth and adoption of cryptocurrencies. Restoring trust requires a multi-faceted approach, including improved regulatory frameworks, increased transparency, and stronger ethical commitments from all stakeholders.

Societal and Economic Consequences

The potential for AI-driven manipulation of cryptocurrency prices poses significant risks to both the societal fabric and the global economy. The decentralized and often unregulated nature of the cryptocurrency market exacerbates these risks, creating a breeding ground for instability and potentially widespread negative consequences if left unchecked. The lack of transparency and the inherent volatility of cryptocurrencies amplify the impact of any manipulative activity, making it crucial to understand the potential ramifications.The widespread adoption of AI-driven price manipulation could erode public trust in the cryptocurrency market, a sector already grappling with issues of volatility and security concerns.

This loss of confidence could deter both individual and institutional investors, hindering the growth and potential benefits of this emerging technology. Furthermore, the potential for significant financial losses for ordinary investors could lead to social unrest and a decline in public support for technological innovation in the financial sector.

Societal Impacts of AI-Driven Cryptocurrency Price Manipulation

The societal consequences of widespread AI-driven cryptocurrency price manipulation are multifaceted. Loss of investor confidence is a primary concern. The perception of unfair manipulation, particularly if it targets smaller, less sophisticated investors, can lead to disillusionment and a retreat from the market. This could stifle innovation and the development of legitimate blockchain-based applications. Furthermore, the potential for significant financial losses could exacerbate existing social inequalities, impacting vulnerable populations disproportionately.

The lack of robust regulatory oversight could also create a perception of systemic injustice, further eroding public trust in both the cryptocurrency market and regulatory bodies.

Economic Consequences of AI-Driven Cryptocurrency Price Manipulation

The economic consequences of AI-driven cryptocurrency price manipulation are potentially far-reaching and severe.

- Impact on Investment: AI-driven manipulation can create artificial price bubbles and crashes, leading to significant losses for investors. This can discourage investment in both cryptocurrencies and related technologies, hindering innovation and economic growth.

- Impact on Employment: The cryptocurrency market employs a significant number of individuals in roles ranging from development and trading to regulatory compliance. Market instability caused by AI manipulation can lead to job losses and economic hardship for these workers.

- Impact on Financial Stability: Widespread AI-driven manipulation could trigger systemic risk within the cryptocurrency ecosystem and potentially spill over into traditional financial markets. The interconnectedness of global financial systems means that a major cryptocurrency crash could have ripple effects throughout the economy.

Systemic Risk Created by AI Manipulation

The decentralized and unregulated nature of the cryptocurrency market makes it particularly vulnerable to systemic risk arising from AI-driven manipulation. Sophisticated AI algorithms can be used to create coordinated attacks that manipulate prices across multiple exchanges simultaneously, making it difficult for regulators to intervene effectively. This lack of centralized control increases the potential for cascading failures, where the collapse of one cryptocurrency or exchange can trigger a domino effect, impacting the entire ecosystem.

The speed and scale at which AI can execute these attacks further amplify the potential for widespread damage. For example, a coordinated attack using multiple AI bots could artificially inflate the price of a cryptocurrency, attracting new investors, before triggering a sudden crash, causing significant losses and potentially triggering a wider market sell-off. This scenario illustrates the potential for AI manipulation to create a systemic risk that far exceeds the impact of individual, human-driven manipulations.

Technological Countermeasures

The detection and prevention of AI-driven cryptocurrency price manipulation require a multi-faceted approach leveraging advanced technological solutions. These solutions aim to identify anomalous trading patterns, pinpoint manipulative actors, and ultimately deter malicious activity by raising the cost and risk of manipulation. The effectiveness of these countermeasures varies depending on the sophistication of the manipulative AI and the robustness of the implemented systems.

Several technological approaches can be employed to combat AI-driven price manipulation. These range from sophisticated anomaly detection algorithms analyzing vast datasets to blockchain-based solutions designed to enhance transparency and traceability of transactions. The effectiveness of each approach is contingent on factors such as data quality, computational resources, and the adaptability of the manipulative AI itself.

Anomaly Detection Systems

Anomaly detection systems form a crucial first line of defense. These systems analyze high-frequency trading data, identifying deviations from established market norms and patterns. Such systems can utilize various algorithms, including machine learning models trained on historical market data to establish baselines of “normal” behavior. Significant deviations from these baselines, such as unusually large or rapid price movements coupled with unusual trading volumes from specific accounts, trigger alerts for human review.

For instance, a sudden surge in buy orders for a specific cryptocurrency from a previously inactive account, followed by an immediate price increase and subsequent sell-off, could be flagged as suspicious. These systems can also incorporate network analysis to identify clusters of coordinated trading activity, further highlighting potential manipulation attempts. The effectiveness of these systems hinges on the quality and comprehensiveness of the training data and the ability of the algorithms to adapt to evolving manipulation techniques.

Blockchain Forensics

Blockchain technology, while often cited for its transparency, can also be a valuable tool in detecting manipulation. Analyzing on-chain data, such as transaction flows and wallet addresses, can reveal patterns indicative of coordinated manipulation efforts. Sophisticated blockchain forensics techniques can trace the origins of funds, identify suspicious wallet activity, and uncover connections between seemingly disparate entities involved in manipulative trading schemes.

For example, identifying large amounts of cryptocurrency moving from a single source to numerous accounts immediately before a price surge could indicate wash trading or other manipulative tactics. However, the effectiveness of blockchain forensics is limited by the inherent anonymity features of some cryptocurrencies and the constant evolution of techniques used to obscure manipulative activities.

Enhanced Transaction Monitoring

Advanced transaction monitoring systems can play a significant role in identifying and preventing AI-driven price manipulation. These systems analyze various aspects of transactions, including order size, frequency, timing, and the involved parties. They can leverage machine learning algorithms to identify unusual patterns and flag potentially manipulative activities. For example, a system could be designed to detect instances of “spoofing,” where large orders are placed to create a false impression of market demand, only to be canceled before execution.

The effectiveness of these systems depends on the sophistication of the algorithms used and the ability to adapt to evolving manipulative strategies. The integration of behavioral biometrics, analyzing user interaction patterns, can further enhance the accuracy of these systems.

System for Detecting Anomalous Trading Patterns, Ethical considerations of using AI for cryptocurrency price manipulation.

A comprehensive system for detecting anomalous trading patterns indicative of AI manipulation would incorporate multiple data sources and algorithms. This system would leverage high-frequency trading data from various exchanges, on-chain data from the relevant blockchain, and potentially social media sentiment analysis to create a holistic view of market activity. The core algorithms would include:

1. Time Series Anomaly Detection: Algorithms like ARIMA or LSTM neural networks would analyze price and volume data to identify deviations from expected patterns. These algorithms are trained on historical data and can detect unusual spikes, drops, or volatility clusters.

2. Network Analysis: Graph algorithms would be used to identify clusters of interconnected accounts engaging in coordinated trading activity. This helps detect wash trading or other forms of market manipulation involving multiple accounts.

3. Machine Learning Classification: Supervised machine learning models, trained on labeled datasets of manipulative and non-manipulative trading activities, would classify transactions based on a range of features, including order size, frequency, timing, and the associated accounts’ historical behavior.

Data sources would include:

- High-frequency trading data from multiple cryptocurrency exchanges.

- On-chain data from the relevant blockchain, including transaction details, wallet addresses, and balances.

- Social media sentiment data to gauge public opinion and identify potential manipulation campaigns.

The Role of Transparency and Accountability

Transparency and accountability are paramount in mitigating the risks associated with AI-driven cryptocurrency price manipulation. Without these crucial elements, the potential for unfair trading practices and market instability significantly increases, eroding investor confidence and hindering the overall growth of the cryptocurrency ecosystem. A robust framework encompassing both transparency in algorithmic operations and accountability for those involved is essential.The importance of transparency extends to all aspects of AI-driven cryptocurrency trading, from the algorithms themselves to the data sources used to train and operate them.

Openly disclosing the methodologies employed in trading algorithms allows for independent scrutiny and verification, reducing the likelihood of hidden manipulative tactics. Similarly, transparently revealing the data sources used ensures that the algorithms are not being fed biased or manipulated data to generate skewed trading signals. This open approach fosters trust and allows for the identification of potential vulnerabilities or biases before they can be exploited.

Transparency in Cryptocurrency Trading Algorithms and Data Sources

A transparent system necessitates the clear articulation of the decision-making processes within AI trading algorithms. This involves detailed documentation of the algorithms’ logic, parameters, and weighting schemes. Furthermore, the provenance and quality of data used to train and feed these algorithms should be meticulously documented and readily available for independent review. This includes detailing data cleaning procedures, the sources of the data (e.g., exchanges, social media sentiment analysis), and any potential biases inherent in the data.

For instance, an algorithm relying solely on data from a single exchange might be susceptible to manipulation if that exchange is compromised. Transparency in this regard enables independent audits and allows researchers and regulators to identify potential weaknesses and vulnerabilities.

Mechanisms for Ensuring Accountability for AI Developers and Users

Establishing accountability requires a multi-pronged approach. First, clear legal and regulatory frameworks must be established to define responsibilities and liabilities for AI developers and users. This includes mechanisms for investigating and prosecuting instances of AI-driven price manipulation. Second, robust auditing mechanisms should be implemented to regularly assess the behavior of AI trading algorithms and ensure they adhere to established regulations and ethical guidelines.

These audits could be conducted by independent third-party organizations specializing in AI and blockchain technology. Third, a system of traceability and attribution is crucial. This involves the ability to track the actions of AI trading algorithms back to their developers and users, allowing for the identification and prosecution of individuals responsible for manipulative activities. A clear chain of custody for algorithmic trading activities is essential for accountability.

Visual Representation of a Transparent Cryptocurrency Trading System

Imagine a flow chart. At the top, we have “Data Sources,” branching into various sources like exchanges (Binance, Coinbase, etc.), social media sentiment analysis tools, and on-chain data providers. These sources feed into a “Data Aggregation and Cleaning” block, where data is validated, cleaned, and standardized. This processed data then flows into the “AI Trading Algorithm,” represented as a central processing unit.

The algorithm’s internal workings (parameters, logic, etc.) are transparently documented and accessible. The algorithm’s output – trading signals – flows into an “Order Execution” block, which interacts directly with cryptocurrency exchanges. Simultaneously, the entire process is monitored by an “Auditing and Oversight” block, which independently verifies the algorithm’s behavior and data integrity. This block feeds into a “Regulatory Compliance” block, ensuring adherence to legal frameworks.

Finally, all actions are recorded in an immutable “Transaction Ledger,” providing a complete and verifiable history of all trading activities. Each block is interconnected, and the flow of information is clearly defined, allowing for comprehensive tracking and accountability.

Final Review

The ethical considerations surrounding AI-driven cryptocurrency price manipulation are complex and far-reaching. While AI offers incredible potential for innovation and efficiency, its misuse poses a significant threat to market integrity, investor confidence, and broader financial stability. Addressing this challenge requires a multi-faceted approach encompassing technological advancements, robust regulatory frameworks, and a strong emphasis on transparency and accountability. Only through collaborative efforts across the industry, regulatory bodies, and the broader community can we harness the power of AI while mitigating its potential for malicious exploitation in the cryptocurrency market.