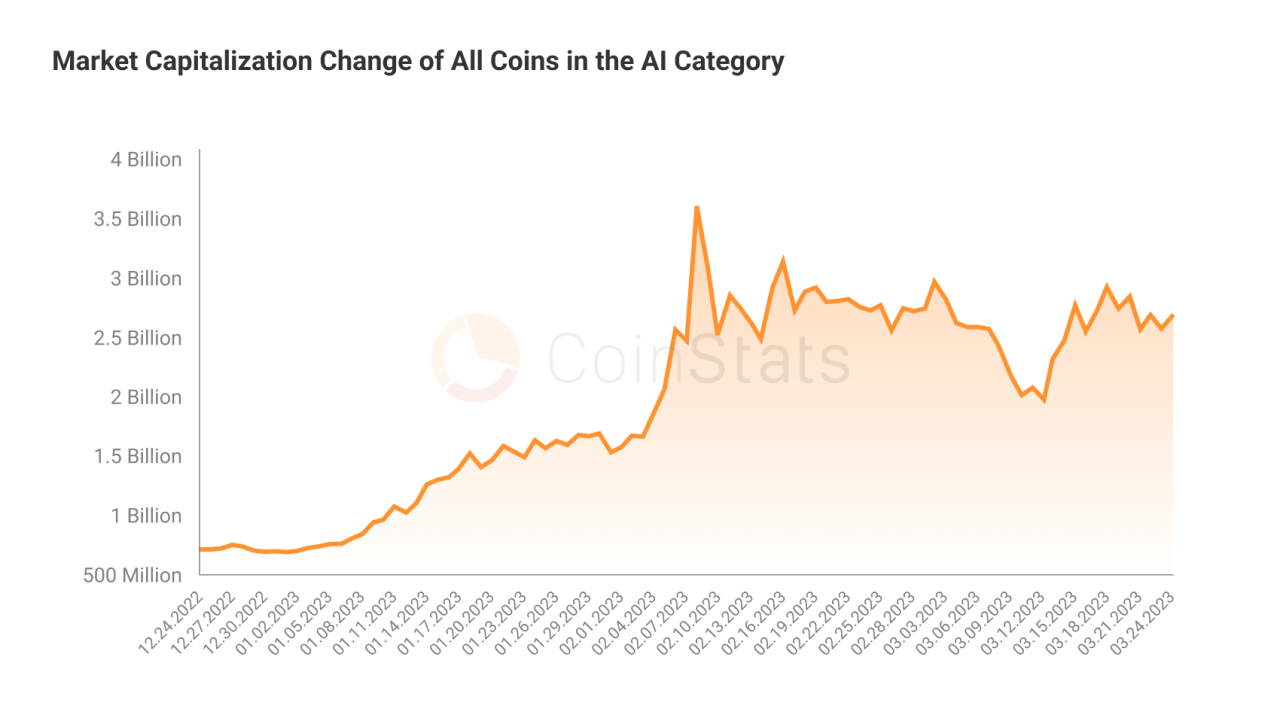

AI’s role in predicting cryptocurrency price volatility is rapidly evolving. The inherent volatility of crypto markets presents a unique challenge, but also a significant opportunity for AI-driven solutions. Machine learning algorithms, fueled by diverse data sources and sophisticated feature engineering, are increasingly being employed to forecast price swings, offering the potential for more informed trading strategies and risk management.

This exploration delves into the techniques, challenges, and future prospects of using AI to navigate the turbulent world of cryptocurrency prices.

From analyzing social media sentiment to processing vast blockchain datasets, AI models are constantly learning and adapting. Understanding the strengths and limitations of various algorithms, such as LSTMs and RNNs, is crucial for developing effective prediction models. This article will examine the key factors contributing to successful AI-driven volatility prediction, including data preprocessing, feature selection, model evaluation, and the ethical implications involved.

AI Techniques for Volatility Prediction

Predicting cryptocurrency price volatility is a complex task, but advancements in artificial intelligence (AI) offer promising tools. Various machine learning algorithms, each with its strengths and weaknesses, are being employed to analyze vast datasets and forecast future volatility. Understanding these techniques and their comparative performance is crucial for informed decision-making in the volatile cryptocurrency market.

Machine Learning Algorithms for Volatility Prediction

Several machine learning algorithms have proven effective in predicting cryptocurrency price volatility. These algorithms leverage historical price data, trading volume, and other relevant factors to build predictive models. The choice of algorithm depends on the specific dataset, desired accuracy, and computational resources available.

- Long Short-Term Memory (LSTM) networks: LSTMs are a type of recurrent neural network (RNN) particularly well-suited for time-series data like cryptocurrency prices. Their ability to handle long-term dependencies in data makes them effective in capturing trends and patterns that might be missed by other algorithms. However, LSTMs can be computationally expensive to train, requiring significant processing power and time. Their effectiveness also hinges on the quality and quantity of training data.

- Recurrent Neural Networks (RNNs): RNNs are designed to process sequential data, making them suitable for analyzing the temporal dynamics of cryptocurrency prices. They can capture patterns and trends over time, but simpler RNN architectures may struggle with long-term dependencies, unlike LSTMs. Overfitting is also a potential issue with RNNs, particularly when dealing with limited data.

- Generalized Autoregressive Conditional Heteroskedasticity (GARCH) models: GARCH models are statistical models specifically designed to model volatility clustering, a characteristic feature of financial time series. They are relatively straightforward to implement and interpret, but their performance can be limited compared to more sophisticated machine learning algorithms, especially when dealing with complex, non-linear relationships in the data.

- Support Vector Machines (SVMs): SVMs are powerful algorithms capable of handling high-dimensional data and identifying complex patterns. They can be effective in predicting volatility, but their performance is sensitive to the choice of kernel function and hyperparameters. Moreover, SVMs can be computationally intensive for large datasets.

Comparative Performance of AI Models

Directly comparing the performance of LSTM, RNN, and GARCH models in predicting cryptocurrency volatility is challenging due to variations in datasets, model parameters, and evaluation metrics. However, studies have shown that LSTM networks often outperform simpler RNNs and GARCH models in terms of accuracy and forecasting ability, particularly when dealing with longer time horizons. GARCH models are often preferred for their simplicity and interpretability, especially when computational resources are limited.

The best-performing model often depends on the specific cryptocurrency and the time period considered. For instance, a study might show an LSTM model achieving a mean absolute percentage error (MAPE) of 10% on Bitcoin price volatility prediction over a one-year period, while a GARCH model achieves a MAPE of 15% on the same data. However, different studies will yield varying results.

Data Preprocessing for Cryptocurrency Volatility Prediction, AI’s role in predicting cryptocurrency price volatility

Before applying any AI model for volatility prediction, thorough data preprocessing is essential. This involves cleaning, transforming, and preparing the raw cryptocurrency data to ensure the model’s accuracy and efficiency. This often includes handling missing values, smoothing noisy data, and scaling features.

| Technique | Description | Advantages | Disadvantages |

|---|---|---|---|

| Missing Value Imputation | Filling in missing data points using methods like mean/median imputation, k-nearest neighbors, or forward/backward fill. | Prevents data loss and allows for complete dataset analysis. | Can introduce bias and distort the original data distribution, especially with complex imputation methods. |

| Outlier Detection and Treatment | Identifying and handling extreme values using methods like z-score, IQR, or DBSCAN. Treatment can involve removal, capping, or transformation. | Reduces the influence of extreme values on model performance and improves robustness. | Can lead to loss of valuable information if outliers represent genuine events. Choosing the right outlier treatment method is crucial. |

| Data Smoothing | Reducing noise and irregularities in the data using techniques like moving averages, exponential smoothing, or wavelet denoising. | Reduces noise and highlights underlying trends. | Can obscure important short-term fluctuations and details in the data. The choice of smoothing parameter is crucial. |

| Feature Scaling | Scaling features to a similar range (e.g., standardization or normalization) to prevent features with larger values from dominating the model. | Improves model performance and convergence speed, especially for algorithms sensitive to feature scaling. | Can affect the interpretability of the model’s coefficients. |

Data Sources and Feature Engineering

Predicting cryptocurrency price volatility accurately requires a multifaceted approach that leverages diverse data sources and sophisticated feature engineering techniques. Relying solely on historical price data is insufficient; incorporating alternative data streams significantly enhances predictive models’ robustness and accuracy. This section explores the crucial role of diverse data sources and the methods employed to extract meaningful features for improved volatility forecasting.The incorporation of diverse data sources is paramount in enhancing the accuracy of cryptocurrency price volatility prediction models.

Traditional time series analysis, while useful, often overlooks crucial external factors influencing market behavior. By integrating data from various sources, we can capture a more holistic picture of market dynamics, leading to more accurate predictions. This integrated approach allows for the identification of subtle correlations and patterns that would otherwise remain hidden.

Diverse Data Sources for Volatility Prediction

Several data sources provide valuable insights into cryptocurrency market volatility. These sources offer different perspectives on market sentiment, trading activity, and network dynamics. For instance, social media sentiment analysis can gauge public opinion and excitement, which often correlates with price fluctuations. High trading volume often indicates increased volatility, while blockchain data reveals network activity and transaction patterns.

Combining these disparate data points provides a richer context for understanding and predicting volatility. For example, a surge in negative social media sentiment coupled with a decrease in trading volume might signal an impending price drop.

Feature Engineering Techniques

Effective feature engineering is crucial for transforming raw data from diverse sources into features that are suitable for machine learning models. This involves selecting, transforming, and creating new variables that capture relevant information and improve model performance. Several techniques are commonly employed:

- Sentiment Analysis: Extracting sentiment scores (positive, negative, neutral) from social media posts, news articles, and online forums related to specific cryptocurrencies. For example, a high proportion of negative sentiment might indicate increased volatility risk.

- Technical Indicators: Calculating traditional technical indicators such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands from price and volume data. These indicators provide insights into price momentum and potential reversals.

- Volume-Based Features: Engineering features based on trading volume, such as average daily volume, volume spikes, and volume-weighted average price (VWAP). Significant changes in trading volume can be indicative of heightened volatility.

- Blockchain Network Metrics: Deriving features from blockchain data, including transaction counts, transaction fees, active addresses, and hash rate. Changes in these metrics can reflect network activity and potentially correlate with price volatility.

- Google Trends Data: Analyzing search interest in specific cryptocurrencies using Google Trends data. A sudden spike in search interest might precede increased volatility.

Feature Selection Process

Selecting the most impactful features is crucial for building effective predictive models. A rigorous feature selection process ensures that only the most relevant features are included, improving model performance and interpretability. Several methods can be used:The process begins with descriptive statistics and correlation analysis to identify features with high variance and strong correlations with the target variable (volatility).

Feature importance scores from tree-based models (like Random Forests or Gradient Boosting Machines) can also be used. Recursive Feature Elimination (RFE) is a useful technique that iteratively removes the least important features until an optimal subset is identified. Finally, model performance metrics (e.g., Mean Absolute Error, Root Mean Squared Error) on a validation set are used to assess the effectiveness of different feature combinations.

The ultimate goal is to select a subset of features that maximizes predictive accuracy while minimizing model complexity. For example, a model might prioritize features like social media sentiment and trading volume over less impactful features like the number of active GitHub repositories for a specific cryptocurrency project.

Model Evaluation and Validation

Accurately assessing the performance and reliability of AI models used for cryptocurrency volatility prediction is crucial for practical application. This involves selecting appropriate evaluation metrics, understanding their limitations, and employing robust validation techniques to mitigate issues like overfitting and data bias. A thorough evaluation process ensures that the model’s predictions are reliable and generalizable to unseen data, minimizing the risk of significant financial losses.Model performance evaluation requires a multifaceted approach that considers both the accuracy of predictions and the model’s ability to generate consistent, profitable trading strategies.

Simply achieving high accuracy might not translate to successful trading, as the timing and magnitude of volatility shifts are equally important. Therefore, a combination of statistical metrics and financial performance indicators is necessary for a complete evaluation.

Evaluation Metrics for Cryptocurrency Volatility Prediction

Several metrics are suitable for evaluating the performance of AI models in predicting cryptocurrency volatility. Root Mean Squared Error (RMSE) and Mean Absolute Error (MAE) quantify the difference between predicted and actual volatility values. The Sharpe Ratio, a risk-adjusted return metric, assesses the model’s ability to generate excess returns relative to the risk taken. Each metric provides a different perspective on model performance.

RMSE and MAE focus on prediction accuracy, while the Sharpe Ratio considers the profitability and risk associated with the predictions.

RMSE = √[Σ(Predictedi

Actuali)² / n]

MAE = Σ|Predictedi

Actuali| / n

The Sharpe Ratio, however, requires a more nuanced approach. It incorporates the standard deviation of the model’s returns as a measure of risk, making it suitable for evaluating the profitability and risk of a trading strategy derived from the volatility predictions.

Sharpe Ratio = (Rp – Rf) / σp

Where Rp is the portfolio return, Rf is the risk-free rate of return, and σp is the standard deviation of the portfolio return. A higher Sharpe Ratio indicates better risk-adjusted performance.

Techniques for Validating Model Robustness

Overfitting and data bias pose significant challenges in building reliable AI models for cryptocurrency volatility prediction. Overfitting occurs when a model learns the training data too well, leading to poor generalization on unseen data. Data bias arises from systematic errors or inaccuracies in the data used to train the model. Several techniques can help mitigate these issues.Cross-validation is a widely used technique to assess model generalization.

K-fold cross-validation divides the dataset into k subsets, training the model on k-1 subsets and validating it on the remaining subset. This process is repeated k times, and the average performance across all folds is used as an estimate of the model’s generalization ability. Another effective method is using a hold-out test set, reserving a portion of the data unseen during training for a final evaluation of the model’s performance on entirely new data.

Careful feature engineering and data cleaning are also essential steps in reducing bias and improving model robustness. Regularization techniques, such as L1 and L2 regularization, can help prevent overfitting by penalizing complex models.

Model Performance Comparison

The table below illustrates the performance of three different AI models—a Long Short-Term Memory (LSTM) network, a Support Vector Regression (SVR) model, and a Random Forest Regressor—using RMSE, MAE, and Sharpe Ratio as evaluation metrics. These results are hypothetical examples and would vary significantly depending on the specific dataset, model parameters, and market conditions.

| Model | RMSE | MAE | Sharpe Ratio |

|---|---|---|---|

| LSTM | 0.08 | 0.06 | 1.2 |

| SVR | 0.10 | 0.07 | 0.9 |

| Random Forest | 0.12 | 0.09 | 0.7 |

Limitations and Challenges: AI’s Role In Predicting Cryptocurrency Price Volatility

Predicting cryptocurrency price volatility using AI, while promising, faces significant limitations stemming from the inherent unpredictability of the market and the complex interplay of numerous factors. Ethical considerations surrounding AI-driven trading strategies also warrant careful attention. Furthermore, the challenges of acquiring and processing real-time data for accurate prediction models pose significant hurdles.The inherent volatility of cryptocurrency markets presents a major challenge for AI prediction models.

Unlike traditional financial markets, cryptocurrencies are susceptible to extreme price swings driven by speculative trading, regulatory changes, technological advancements, and social media sentiment. These unpredictable events can render even the most sophisticated AI models ineffective. For example, the sudden collapse of FTX in 2022 dramatically impacted the entire cryptocurrency market, an event that no AI model could have accurately predicted.

External factors such as macroeconomic conditions, geopolitical events, and even celebrity endorsements also significantly influence cryptocurrency prices, adding further complexity to prediction tasks.

Market Unpredictability and External Factors

The cryptocurrency market is characterized by its high volatility and susceptibility to unpredictable events. News cycles, regulatory announcements, technological breakthroughs, and even social media trends can cause dramatic price swings in a short period. This inherent unpredictability makes accurate price prediction exceptionally difficult, even for sophisticated AI models. For instance, a sudden regulatory crackdown in a major jurisdiction could trigger a significant market correction, regardless of underlying technical indicators.

Similarly, a positive development in the underlying blockchain technology might drive substantial price appreciation. These external factors often outweigh the influence of technical indicators and historical price patterns that AI models typically rely on.

Ethical Considerations in AI-Driven Cryptocurrency Trading

The use of AI in cryptocurrency trading raises several ethical concerns. The potential for algorithmic manipulation, insider trading through access to privileged information, and the creation of unfair trading advantages for those with access to advanced AI systems are significant risks. Moreover, the “black box” nature of some AI models can make it difficult to understand the reasoning behind their predictions, leading to a lack of transparency and accountability.

This opacity can exacerbate risks, particularly for less sophisticated investors who might rely on AI-driven trading signals without fully understanding their implications. Consider, for instance, the potential for a sophisticated AI to exploit market inefficiencies, potentially driving up prices artificially or creating opportunities for predatory trading practices.

Real-Time Data Acquisition and Processing

Accurate cryptocurrency price volatility prediction heavily relies on real-time data. However, acquiring and processing this data presents significant challenges. The decentralized nature of many cryptocurrency exchanges and the lack of standardized data formats can make data aggregation difficult and time-consuming. Real-time data feeds are often expensive and may suffer from latency issues, leading to inaccuracies in prediction models.

Furthermore, the sheer volume of data generated by cryptocurrency markets requires robust and scalable data processing infrastructure to handle the computational demands of advanced AI algorithms. Delayed or incomplete data can lead to inaccurate predictions and potentially costly trading decisions. For example, a delay in receiving information about a significant market event could result in a missed opportunity or a poorly timed trade, highlighting the importance of real-time data accuracy.

Future Directions and Advancements

The prediction of cryptocurrency price volatility using AI is a rapidly evolving field. Significant improvements in accuracy and efficiency are anticipated through the integration of more advanced techniques, enhanced data processing capabilities, and a more holistic approach to risk management. Further advancements will not only refine existing models but also unlock entirely new possibilities for navigating the complexities of the cryptocurrency market.The application of AI to cryptocurrency volatility prediction is poised for substantial growth.

This progress will stem from both methodological improvements in AI algorithms and advancements in the supporting infrastructure for data acquisition and analysis.

Reinforcement Learning and Hybrid Models

Reinforcement learning (RL) offers a promising avenue for enhancing volatility prediction. Unlike supervised learning methods that rely on historical data, RL algorithms learn through trial and error, adapting their strategies in response to market dynamics. By training an RL agent to optimize trading strategies based on real-time market data and volatility indicators, more robust and adaptable prediction models can be developed.

Hybrid models, combining RL with other AI techniques such as deep learning, could further enhance predictive power by leveraging the strengths of each approach. For example, a hybrid model might use a deep learning component to identify relevant patterns in historical data, while an RL component optimizes trading decisions based on these patterns and real-time market conditions. This synergistic approach could lead to more accurate and responsive volatility predictions.

Advancements in Data Analysis and Computing Power

Increased computational power and the development of more sophisticated data analysis techniques are crucial for improving AI-driven volatility prediction. The sheer volume and velocity of cryptocurrency market data present significant challenges. The ability to process and analyze this data efficiently is paramount. Advancements in parallel processing, distributed computing, and specialized hardware (like GPUs) allow for faster training of complex AI models and real-time analysis of market data.

Moreover, improvements in techniques like natural language processing (NLP) enable the incorporation of news sentiment and social media data, providing valuable contextual information that can significantly enhance predictive accuracy. For instance, the analysis of news articles related to a specific cryptocurrency can provide insights into potential price movements, which can then be integrated into an AI model to improve its predictive capabilities.

AI Integration with Other Analytical Tools

A comprehensive approach to cryptocurrency risk management requires the integration of AI with other analytical tools. Combining AI-driven volatility predictions with traditional financial analysis techniques, such as technical indicators and fundamental analysis, can provide a more robust and nuanced understanding of market risks. For example, AI models can be used to identify subtle patterns and anomalies in market data that might be missed by traditional methods, while traditional techniques can provide a broader macroeconomic context for interpreting AI-generated predictions.

This integrated approach, which incorporates both quantitative and qualitative data, will lead to more informed decision-making and more effective risk management strategies. Furthermore, incorporating blockchain analytics can provide deeper insights into transaction patterns and network activity, providing additional data points for AI models to process and utilize in their predictions. This integrated approach would allow for a more comprehensive and robust risk management strategy.

End of Discussion

Predicting cryptocurrency price volatility remains a complex undertaking, fraught with challenges. While AI offers powerful tools to improve forecasting accuracy, it’s crucial to acknowledge its limitations and the inherent unpredictability of the market. However, ongoing advancements in AI techniques, coupled with increased computing power and access to diverse data sources, promise a future where AI plays an even more significant role in navigating the risks and opportunities within the cryptocurrency landscape.

The ethical considerations surrounding AI-driven trading decisions must remain a central focus as this technology continues to mature.