The accuracy of AI algorithms in predicting cryptocurrency price movements. – The accuracy of AI algorithms in predicting cryptocurrency price movements is a hotly debated topic. While artificial intelligence offers the promise of uncovering hidden patterns in the volatile crypto market, its actual predictive power remains a significant challenge. This exploration delves into the methodologies employed, the limitations encountered, and the factors influencing the success—or failure—of AI in forecasting crypto price fluctuations.

We’ll examine the data sources, algorithm selection, evaluation metrics, and external influences that shape the accuracy of these predictions.

From analyzing historical price data and social media sentiment to employing sophisticated machine learning techniques like LSTMs and RNNs, we’ll dissect the entire process. We will also critically assess the limitations of relying solely on quantitative metrics in a market as unpredictable as cryptocurrency, exploring scenarios where high accuracy scores can be misleading. Ultimately, this analysis aims to provide a balanced perspective on the capabilities and constraints of AI in navigating the complex world of cryptocurrency price prediction.

Data Sources and Preprocessing

Accurate cryptocurrency price prediction relies heavily on the quality and preparation of the input data. AI algorithms, while powerful, are only as good as the data they are trained on. Therefore, understanding the sources of this data and the preprocessing techniques employed is crucial for evaluating the reliability of any prediction model.The selection and preprocessing of data significantly impact the accuracy and robustness of AI models used for cryptocurrency price prediction.

Careful consideration must be given to the various data sources, their inherent biases, and the necessary steps to transform raw data into a suitable format for machine learning algorithms.

Data Sources for Cryptocurrency Price Prediction

Several data sources contribute to building effective AI models for cryptocurrency price prediction. Each source offers unique advantages and disadvantages, impacting the model’s performance. The following table summarizes key data sources and their characteristics:

| Data Source | Advantages | Disadvantages | Example |

|---|---|---|---|

| Historical Price Data (OHLCV) | Readily available, provides a clear picture of price trends, forms the basis for most technical analysis. | Can be noisy, susceptible to manipulation, historical data may not be indicative of future performance. | Open, High, Low, Close, Volume data from exchanges like Binance or Coinbase. |

| Trading Volume | Indicates market interest and liquidity, can signal potential price movements. | Can be manipulated, doesn’t always directly correlate with price changes. | Daily/hourly trading volume for Bitcoin on Kraken. |

| Social Media Sentiment | Captures market sentiment, provides insights into public perception, can reveal emerging trends. | Difficult to quantify and interpret objectively, susceptible to manipulation (e.g., bots, fake news). | Sentiment analysis of tweets mentioning Bitcoin. |

| On-Chain Metrics | Provides insights into network activity, can indicate adoption and future price movements (e.g., transaction fees, active addresses). | Requires specialized knowledge to interpret, data can lag behind price movements. | Number of active Bitcoin addresses on the blockchain. |

Data Preprocessing Techniques

Raw cryptocurrency data is often noisy and requires significant preprocessing before being used to train AI models. This involves several crucial steps:Data cleaning addresses inconsistencies, errors, and outliers in the dataset. For example, removing duplicate entries, handling missing values, and smoothing out price spikes caused by flash crashes are essential. Normalization or standardization transforms data into a consistent range, preventing features with larger values from dominating the model’s learning process.

Common methods include Min-Max scaling and Z-score standardization. Feature engineering involves creating new features from existing ones to improve model performance. For example, technical indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands can be derived from historical price data.

Handling Missing Data

Missing data is a common challenge in cryptocurrency price prediction. Various imputation methods can be employed to handle this issue:Several imputation techniques exist to address missing data. Mean/median imputation replaces missing values with the average or median of the available data. This is simple but can distort the distribution if many values are missing. K-Nearest Neighbors (KNN) imputation uses the values of the k nearest data points to estimate the missing values, offering a more sophisticated approach.

Multiple imputation generates multiple plausible imputed datasets, providing a more robust estimation and accounting for uncertainty in the imputation process. The choice of imputation method depends on the nature and extent of the missing data, as well as the characteristics of the dataset. Incorrect imputation can lead to biased model predictions, reducing accuracy and reliability. For instance, using simple mean imputation on a dataset with significant outliers could lead to inaccurate predictions.

More sophisticated methods like KNN or multiple imputation are often preferred to mitigate such issues.

AI Algorithm Selection and Implementation

Predicting cryptocurrency price movements using AI requires careful selection and implementation of appropriate algorithms. The choice depends on factors such as data characteristics, computational resources, and desired prediction accuracy. This section details the selection process, hyperparameter tuning, and a step-by-step implementation guide for a chosen algorithm.

Comparison of AI Algorithms for Cryptocurrency Price Prediction

Several AI algorithms can be applied to predict cryptocurrency price movements. The choice depends on the complexity of the data and the desired level of accuracy. The following table compares and contrasts some popular options.

| Algorithm | Type | Advantages | Disadvantages |

|---|---|---|---|

| Linear Regression | Machine Learning | Simple to implement, computationally inexpensive, interpretable. | Assumes linear relationship, sensitive to outliers, may not capture complex patterns. |

| Support Vector Machines (SVM) | Machine Learning | Effective in high-dimensional spaces, versatile kernel functions. | Computationally expensive for large datasets, parameter tuning can be challenging. |

| Long Short-Term Memory (LSTM) | Deep Learning | Handles sequential data effectively, captures long-term dependencies in time series. | Computationally intensive, requires significant training data, prone to overfitting. |

| Recurrent Neural Network (RNN) | Deep Learning | Handles sequential data, can capture temporal dependencies. | Can suffer from vanishing/exploding gradients, computationally expensive. |

Hyperparameter Tuning for Optimized Algorithm Performance

Hyperparameter tuning is crucial for optimizing the chosen AI algorithm’s predictive performance. This involves adjusting parameters that control the learning process, such as learning rate, number of hidden layers (in deep learning models), and regularization strength. Techniques like grid search, random search, and Bayesian optimization can be employed to efficiently explore the hyperparameter space and find the optimal combination that minimizes prediction error.

For example, in an LSTM model for Bitcoin price prediction, tuning the learning rate can significantly impact convergence speed and prevent overfitting. A learning rate that is too high might lead to oscillations and prevent the model from converging, while a rate that is too low might lead to slow convergence and potentially get stuck in a local minimum.

Regularization techniques, such as dropout, can help prevent overfitting by randomly ignoring neurons during training.

Step-by-Step Implementation of an LSTM Algorithm for Cryptocurrency Price Prediction

This section Artikels a step-by-step procedure for implementing an LSTM model, a popular choice for time series prediction. Other algorithms would follow a similar structure, with adjustments in the specific model and hyperparameters.

- Data Preparation: This involves cleaning, preprocessing, and formatting the cryptocurrency price data. This includes handling missing values, scaling the data (e.g., using MinMaxScaler), and potentially creating lagged features to capture historical price patterns. For example, one might create features representing the price from the previous day, week, or month.

- Model Building: An LSTM model is constructed with appropriate layers, including input, LSTM layers, and an output layer. The number of LSTM units, layers, and activation functions need to be determined based on the data and experimental results. For instance, a model might have two LSTM layers with 50 units each, followed by a dense layer with a single output neuron for price prediction.

- Model Training: The model is trained using the prepared data. This involves feeding the model input sequences and corresponding target prices. The model adjusts its internal weights to minimize the prediction error (e.g., using Mean Squared Error). Early stopping can be employed to prevent overfitting by monitoring performance on a validation set and stopping training when performance plateaus or starts to decrease.

- Model Evaluation: The trained model is evaluated using appropriate metrics such as Mean Absolute Error (MAE), Root Mean Squared Error (RMSE), and R-squared. These metrics quantify the accuracy of the model’s predictions. A backtesting strategy should be employed to assess the model’s performance on unseen data. This would involve using historical data to simulate trades and evaluate profitability.

Model Evaluation Metrics and Limitations

Evaluating the performance of AI algorithms designed to predict cryptocurrency price movements requires careful consideration of appropriate metrics and a thorough understanding of their limitations. While traditional statistical measures offer insights, the inherent volatility and complexity of the cryptocurrency market necessitate a nuanced interpretation of results. Over-reliance on single metrics can lead to inaccurate assessments of model effectiveness.The accuracy of AI-driven cryptocurrency price predictions is typically assessed using a range of statistical metrics, each offering a unique perspective on model performance.

However, the suitability of these metrics is often debated due to the unique characteristics of cryptocurrency markets.

Mean Absolute Error (MAE), Root Mean Squared Error (RMSE), and R-squared

MAE, RMSE, and R-squared are commonly employed metrics in regression analysis. MAE represents the average absolute difference between predicted and actual prices. RMSE, a more sensitive metric, squares the differences before averaging, penalizing larger errors more heavily. R-squared, on the other hand, indicates the proportion of variance in the actual prices explained by the model’s predictions, ranging from 0 to 1, with higher values suggesting better fit.

For instance, an MAE of $10 indicates that, on average, the model’s predictions are off by $10. An RMSE of $20 suggests a greater dispersion of errors, with larger prediction errors contributing more significantly to the overall score. An R-squared of 0.8 suggests that the model explains 80% of the variance in the price data.

Limitations of Traditional Metrics in Volatile Markets

Applying these metrics directly to cryptocurrency price prediction presents several challenges. The extreme volatility inherent in cryptocurrency markets can lead to misleadingly high or low accuracy scores. For example, a model might achieve a high R-squared value during a period of sustained upward or downward trends, even if its predictions are inaccurate during periods of high volatility. Consider a scenario where Bitcoin experiences a sharp, unexpected price surge.

A model that consistently underestimates the price during this period might still report a relatively high R-squared if the overall trend remains positive. This highlights the limitation of relying solely on R-squared, as it doesn’t capture the magnitude of errors. Similarly, a model might exhibit a low MAE during periods of low volatility, but perform poorly during periods of sharp price fluctuations.

Scenarios Where High Accuracy Scores Can Be Misleading

A high accuracy score, as measured by MAE, RMSE, or R-squared, doesn’t necessarily translate to profitable trading strategies. Several scenarios illustrate this limitation:

High accuracy during a bull market might not reflect the model’s ability to predict during bear markets.

A model might accurately predict small price fluctuations but fail to anticipate major market shifts, leading to significant losses. For example, a model might accurately predict daily price changes of a few percent, but fail to predict a 20% drop caused by a regulatory announcement. This highlights the limitation of using metrics that focus on average error, ignoring the potential for catastrophic errors.

Overfitting can lead to high accuracy on training data but poor performance on unseen data.

A model that overfits to historical data might achieve a high R-squared on the training set but fail to generalize to new, unseen data, leading to poor predictive performance in the real world. This is particularly problematic in cryptocurrency markets, where patterns can change rapidly. For example, a model trained on data from a period of high trading volume might perform poorly during a period of low volume.

The metrics do not consider transaction costs and slippage.

The accuracy metrics do not incorporate real-world trading costs such as transaction fees and slippage (the difference between the expected price and the actual execution price). A model might achieve a high R-squared but still result in losses when transaction costs are factored in. For example, a model predicting small price movements might generate many trades with high transaction costs, negating any profits generated from accurate predictions.

Factors Influencing Prediction Accuracy

Predicting cryptocurrency price movements using AI algorithms is a complex undertaking, significantly influenced by inherent market characteristics and external factors. The accuracy of these predictions is not solely dependent on the sophistication of the algorithm itself, but rather on the interplay of various dynamic elements impacting the cryptocurrency market. Understanding these factors is crucial for interpreting AI-generated predictions and managing expectations.The accuracy of AI-driven cryptocurrency price predictions is heavily influenced by the inherent volatility of the market and external events.

These factors introduce significant noise into the data, making it challenging for even the most advanced algorithms to discern meaningful patterns and generate reliable forecasts.

Market Volatility’s Impact on Prediction Accuracy, The accuracy of AI algorithms in predicting cryptocurrency price movements.

Market volatility in cryptocurrencies is considerably higher than in traditional financial markets. This extreme price fluctuation directly impacts the accuracy of AI predictions. Algorithms trained on historical data struggle to adapt to sudden, unpredictable shifts.

- Short-Term Volatility: Rapid, short-lived price swings, often caused by news events or trading activity, make it difficult for algorithms to establish consistent trends. These fluctuations can lead to significant errors in short-term price predictions.

- Long-Term Volatility: While less frequent than short-term fluctuations, significant long-term price movements, such as the bull and bear markets experienced by Bitcoin, can render models trained on data from a specific period less effective in predicting future prices outside that period’s characteristics.

- Flash Crashes: Sudden and dramatic price drops, often caused by technical glitches or large sell-offs, are nearly impossible for AI algorithms to predict accurately. These events represent outliers in the data, skewing models and reducing prediction accuracy.

Influence of News Events and Social Media Sentiment

News events and social media sentiment significantly influence cryptocurrency prices, often leading to rapid price swings. AI algorithms struggle to incorporate these real-time, qualitative factors into their quantitative models.For example, positive news about a specific cryptocurrency, such as a major exchange listing or a partnership announcement, can trigger a rapid price increase. Conversely, negative news, such as regulatory crackdowns or security breaches, can lead to sharp price declines.

Similarly, a surge in positive sentiment on social media platforms like Twitter can drive up prices, while negative sentiment can lead to sell-offs. The 2021 Dogecoin surge, fueled largely by Elon Musk’s tweets, exemplifies the unpredictable impact of social media sentiment on cryptocurrency prices and the difficulty AI algorithms face in accounting for this influence. The algorithm might detect the tweet, but accurately predicting the magnitude and duration of the resulting price movement is highly challenging.

Impact of Regulatory Changes and Technological Advancements

Regulatory changes and technological advancements can dramatically alter the cryptocurrency landscape, impacting the accuracy of AI predictions. New regulations, such as those related to taxation or trading, can shift market dynamics and render existing models obsolete. Technological advancements, such as the introduction of new blockchain technologies or improved mining hardware, can also significantly affect price predictions.For instance, the introduction of new privacy-focused cryptocurrencies or the implementation of stricter KYC/AML regulations could alter market behavior in unpredictable ways.

Similarly, the development of more energy-efficient mining techniques could affect the cost of mining and, consequently, the price of cryptocurrencies. AI algorithms need to be continuously updated and retrained to adapt to these evolving factors. A model trained before the introduction of a major regulatory change might produce significantly inaccurate predictions afterward.

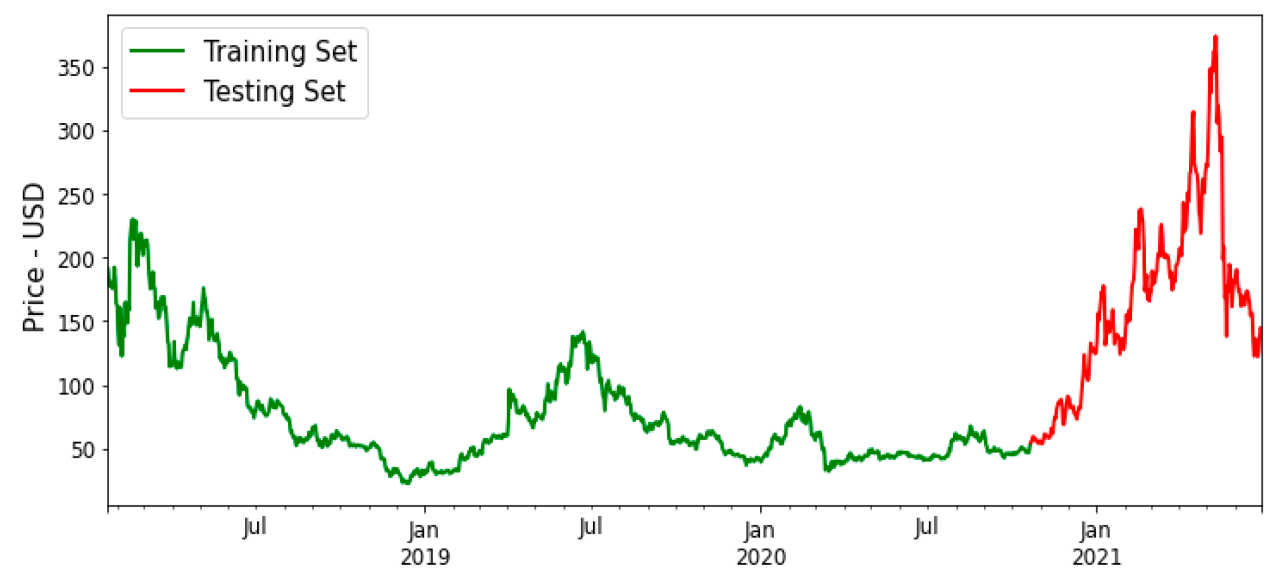

Visualizing Model Performance: The Accuracy Of AI Algorithms In Predicting Cryptocurrency Price Movements.

Effective visualization is crucial for understanding the performance of AI algorithms in predicting cryptocurrency price movements. Graphs and charts allow for a clear and concise representation of complex data, enabling easier identification of patterns, strengths, and weaknesses in the predictive models. This section details several visualization techniques to effectively communicate model performance.

Predicted vs. Actual Cryptocurrency Prices

A line graph is ideal for visualizing the predicted versus actual cryptocurrency prices over time. The x-axis represents the time period (e.g., daily, weekly, or monthly intervals over a specified range, such as three months or a year), and the y-axis represents the cryptocurrency price (e.g., in USD). Two lines are plotted on the same graph: one representing the actual cryptocurrency price obtained from a reliable source like CoinMarketCap, and the other representing the price predicted by the AI model.

A legend clearly distinguishes between the actual and predicted prices. For example, a graph showing Bitcoin’s price over a three-month period might reveal that the model accurately predicted major price swings but underestimated the magnitude of some fluctuations. The closer the predicted line tracks the actual price line, the better the model’s performance. Areas where the lines diverge highlight periods of significant prediction error.

Comparison of AI Algorithm Performance

A bar chart effectively compares the performance of different AI algorithms. Each bar represents an algorithm (e.g., LSTM, ARIMA, Prophet), and the bar’s height represents a chosen evaluation metric, such as Mean Absolute Error (MAE), Root Mean Squared Error (RMSE), or R-squared. The x-axis lists the different algorithms, and the y-axis represents the value of the chosen metric.

Lower values generally indicate better performance (for MAE and RMSE). A chart might show that an LSTM model has a lower MAE than an ARIMA model, suggesting superior predictive accuracy for this specific dataset and timeframe. Including error bars representing the confidence intervals of each metric adds further detail and enhances the visualization’s informative value.

Visualizing Confidence Intervals

Confidence intervals visually represent the uncertainty associated with the AI model’s predictions. This can be achieved by adding shaded regions around the predicted price line in the predicted vs. actual price graph described earlier. The width of the shaded region corresponds to the confidence interval (e.g., 95% confidence interval). A narrower band indicates higher confidence in the prediction, while a wider band signifies greater uncertainty.

For instance, during periods of high market volatility, the confidence interval might widen, reflecting the model’s decreased certainty in its predictions. This visual representation helps users understand the level of reliability associated with each prediction, providing a more nuanced perspective on the model’s capabilities. Including numerical values for the upper and lower bounds of the confidence intervals on the graph further enhances its clarity.

Conclusion

Predicting cryptocurrency prices with AI remains a complex undertaking, fraught with challenges stemming from market volatility, the influence of external factors, and the inherent limitations of current algorithms. While AI can identify trends and patterns, it’s crucial to acknowledge that it’s not a crystal ball. The accuracy of AI predictions is significantly influenced by data quality, algorithm selection, and the ever-changing dynamics of the cryptocurrency landscape.

A holistic approach, combining AI insights with fundamental and technical analysis, is likely to yield more reliable results than relying solely on algorithmic predictions. Continuous research and refinement of AI models are essential to improve their predictive accuracy in this dynamic and unpredictable market.