Comparing AI-based cryptocurrency price predictions with traditional methods. – Comparing AI-based cryptocurrency price predictions with traditional methods reveals a fascinating dichotomy. While traditional methods like fundamental and technical analysis rely on human interpretation of market trends and financial indicators, AI leverages machine learning algorithms to identify patterns and predict price movements from vast datasets. This exploration delves into the strengths and weaknesses of each approach, examining data sources, model development, and predictive accuracy across various cryptocurrencies.

We’ll uncover which method reigns supreme and whether a hybrid approach offers the most promising path to accurate price forecasting.

This comparison investigates the core methodologies, data preprocessing techniques, and evaluation metrics employed by both AI and traditional approaches. We’ll analyze the performance of each in predicting cryptocurrency prices, considering factors such as market volatility and unforeseen events. Ultimately, this analysis aims to illuminate the potential of AI in revolutionizing cryptocurrency price prediction and the possibilities of integrating AI with established traditional methods.

Comparing AI-Based and Traditional Cryptocurrency Price Prediction Methods

Predicting cryptocurrency prices remains a significant challenge, attracting diverse approaches. This section delves into the core principles of both AI-based and traditional methods, highlighting their strengths and weaknesses to provide a comprehensive comparison. Understanding these differences is crucial for navigating the complexities of the cryptocurrency market.

AI-Based Cryptocurrency Price Prediction Methods

AI-based price prediction leverages the power of machine learning (ML), deep learning (DL), and neural networks to analyze vast datasets and identify patterns indicative of future price movements. These algorithms learn from historical data, encompassing price fluctuations, trading volume, social media sentiment, and other relevant factors. Deep learning, a subset of ML, utilizes artificial neural networks with multiple layers to extract complex features and relationships from data, often achieving higher accuracy than simpler ML models.

Neural networks, the building blocks of DL, consist of interconnected nodes that process information and learn through iterative adjustments of their internal parameters. The complexity and adaptability of these models allow them to capture intricate market dynamics that might be missed by human analysts. For instance, a recurrent neural network (RNN) can effectively analyze time-series data, capturing the temporal dependencies crucial for predicting price trends.

Traditional Cryptocurrency Price Prediction Methods

Traditional methods rely on established financial analysis techniques. Fundamental analysis focuses on evaluating the intrinsic value of a cryptocurrency based on its underlying technology, adoption rate, development team, and market capitalization. This approach attempts to determine whether a cryptocurrency is undervalued or overvalued relative to its potential. Technical analysis, on the other hand, uses historical price and volume data to identify patterns and trends, predicting future price movements based on chart patterns, indicators (like RSI and MACD), and support/resistance levels.

This method focuses on price action and market sentiment, often disregarding the underlying fundamentals. Successful technical analysis requires a deep understanding of chart patterns and the ability to interpret market signals.

Comparison of AI-Based and Traditional Methods

The following table summarizes the strengths and weaknesses of both AI-based and traditional cryptocurrency price prediction approaches:

| Method | Strengths | Weaknesses | Example |

|---|---|---|---|

| AI-Based (e.g., LSTM Neural Network) | Can analyze large datasets, identify complex patterns, adapt to changing market conditions, potentially higher accuracy. | Requires significant computational resources, data quality is crucial, model interpretability can be challenging, prone to overfitting if not properly trained. | Predicting Bitcoin price using historical price data, trading volume, and social media sentiment. |

| Fundamental Analysis | Focuses on intrinsic value, less susceptible to short-term market fluctuations, provides a long-term perspective. | Subjective, difficult to quantify certain factors (e.g., community sentiment), time-consuming, may not capture short-term price swings. | Evaluating the potential of a new cryptocurrency based on its whitepaper, development team, and technology. |

| Technical Analysis | Relatively easy to learn and apply, focuses on price action and market sentiment, useful for short-term trading strategies. | Subjective interpretation of charts and indicators, susceptible to false signals, lagging indicators, doesn’t consider fundamental factors. | Identifying a potential buying opportunity based on a bullish candlestick pattern and RSI indicator. |

Data Sources and Preprocessing

AI-based and traditional cryptocurrency price prediction methods rely on distinct data sources and preprocessing techniques. Understanding these differences is crucial for evaluating the strengths and weaknesses of each approach. This section details the data used, its origin, and the transformations applied before model training or analysis.

AI-based prediction models leverage a diverse range of data sources to capture the multifaceted nature of cryptocurrency markets. These sources often extend beyond traditional financial data, incorporating alternative data streams for a more holistic view.

Data Sources for AI-Based Predictions

AI methods often incorporate a broader spectrum of data compared to traditional techniques. This includes high-frequency market data, sentiment analysis from social media platforms, news articles, and blockchain transaction data. Market data encompasses price, volume, and order book information from various exchanges, providing a granular view of market activity. Social media sentiment, extracted through natural language processing (NLP) techniques, gauges public opinion towards specific cryptocurrencies.

News articles, similarly analyzed using NLP, identify market-moving events and their potential impact on prices. Finally, blockchain data, such as transaction volume and network activity, offers insights into the underlying health and adoption of a cryptocurrency. For example, a surge in on-chain activity might signal increased investor interest and potentially higher prices.

Data Sources for Traditional Price Prediction Methods

Traditional methods, such as technical analysis and fundamental analysis, primarily rely on readily available financial data. Technical analysis utilizes historical price and volume data from trading charts to identify patterns and trends. This involves analyzing indicators like moving averages, relative strength index (RSI), and Bollinger Bands. Fundamental analysis, on the other hand, focuses on macroeconomic factors, financial reports of related companies, and market indices to assess the intrinsic value of a cryptocurrency.

For instance, examining a company’s balance sheet or a government’s monetary policy could provide insights into a cryptocurrency’s potential price movements.

Data Preprocessing Techniques: A Comparison

Both AI-based and traditional methods require significant data preprocessing. However, the specific techniques employed differ considerably. AI models often necessitate extensive data cleaning, transformation, and feature engineering to handle the high dimensionality and heterogeneity of the data sources. Traditional methods, while requiring data cleaning, typically involve less complex transformations.

Data Preprocessing Pipeline: A Flowchart Illustration

The following description details the data preprocessing pipeline for both AI and traditional methods. Imagine a flowchart with two parallel branches, one for AI and one for traditional methods. Both start with data collection.

AI-Based Methods: The data collection stage gathers market data (price, volume), social media data (tweets, posts), news articles, and blockchain data. This is followed by data cleaning (handling missing values, outliers), data transformation (normalization, standardization), and feature engineering (creating new features from existing ones, such as technical indicators derived from market data or sentiment scores from text analysis). Finally, the processed data is ready for model training.

Traditional Methods: The data collection focuses on historical price and volume data from trading charts and financial reports. Data cleaning involves handling missing values and outliers. Data transformation might include calculating moving averages or other technical indicators. Feature engineering is less extensive than in AI methods, often focusing on creating technical indicators. The processed data is then used for chart analysis and indicator interpretation.

Model Development and Evaluation Metrics: Comparing AI-based Cryptocurrency Price Predictions With Traditional Methods.

Developing accurate cryptocurrency price prediction models requires careful selection of appropriate algorithms and rigorous evaluation using relevant metrics. This section details the architecture of various AI models commonly employed, the key performance indicators (KPIs) used to assess their accuracy, and a comparison with traditional forecasting techniques. Furthermore, we explore how these different approaches can be combined for improved predictive power.AI models offer a powerful alternative to traditional methods, leveraging complex patterns and relationships within cryptocurrency market data that may be missed by simpler approaches.

The choice of model depends heavily on the nature of the data and the desired level of predictive accuracy.

AI Model Architectures for Cryptocurrency Price Prediction

Several AI architectures have demonstrated potential in forecasting cryptocurrency prices. Recurrent Neural Networks (RNNs), particularly Long Short-Term Memory (LSTM) networks, are well-suited for time-series data due to their ability to capture temporal dependencies. LSTMs address the vanishing gradient problem inherent in standard RNNs, allowing them to learn long-range dependencies in price data more effectively. Another popular choice is Support Vector Machines (SVMs), which are effective in high-dimensional spaces and can handle non-linear relationships between variables.

Other models, such as Artificial Neural Networks (ANNs) with various architectures, and more recently, transformer-based models, are also being explored. The specific architecture and hyperparameter tuning are crucial for optimal performance. For instance, an LSTM might utilize multiple layers and different activation functions to optimize its ability to learn intricate patterns in price fluctuations.

Key Performance Indicators (KPIs) for AI Model Evaluation

Evaluating the accuracy of AI models relies on several key performance indicators. Mean Absolute Error (MAE) measures the average absolute difference between predicted and actual prices, providing a simple and interpretable measure of prediction error. Root Mean Squared Error (RMSE) squares the differences before averaging, giving greater weight to larger errors. R-squared (R²) indicates the proportion of variance in the dependent variable (price) that is predictable from the independent variables (predictors).

A higher R² value suggests a better fit. Other metrics, such as Mean Absolute Percentage Error (MAPE) and Directional Accuracy (DA), may also be employed, depending on the specific application and desired focus. For example, if the goal is to predict the direction of price movement (up or down), DA would be a more relevant metric than RMSE.

Comparison with Traditional Forecasting Techniques

Traditional forecasting methods, such as ARIMA (Autoregressive Integrated Moving Average) models and exponential smoothing, typically rely on statistical assumptions and simpler mathematical formulations. Their evaluation often involves similar metrics like MAE and RMSE, but the interpretation might differ slightly due to the underlying model assumptions. For instance, the residuals of an ARIMA model are expected to be normally distributed, a condition that isn’t explicitly assumed in most AI models.

Traditional methods are often easier to interpret and understand, while AI models, particularly deep learning models, can be considered “black boxes” due to their complexity, making it harder to understand the underlying reasons for their predictions. R² is commonly used in both traditional and AI model evaluations to assess the goodness of fit.

Combining AI and Traditional Methods

Hybrid approaches, combining AI and traditional methods, can leverage the strengths of both. For instance, an AI model might be used to identify significant patterns in the data, while a traditional method like ARIMA might be used to model the remaining, more predictable components of the price series. Alternatively, an AI model could be used to forecast short-term price movements, while a traditional model forecasts longer-term trends.

Such hybrid approaches can lead to more robust and accurate predictions than relying on a single method alone. A real-world example might involve using an LSTM to predict daily price fluctuations, and an ARIMA model to predict monthly or yearly trends, combining the predictions to achieve a more comprehensive forecast.

Case Studies

This section presents case studies comparing the predictive accuracy of AI-based and traditional cryptocurrency price prediction methods. We examine specific model implementations and their performance against established statistical techniques, analyzing results across various cryptocurrencies to identify strengths and weaknesses of each approach. The analysis focuses on quantifiable metrics to provide a clear and objective comparison.

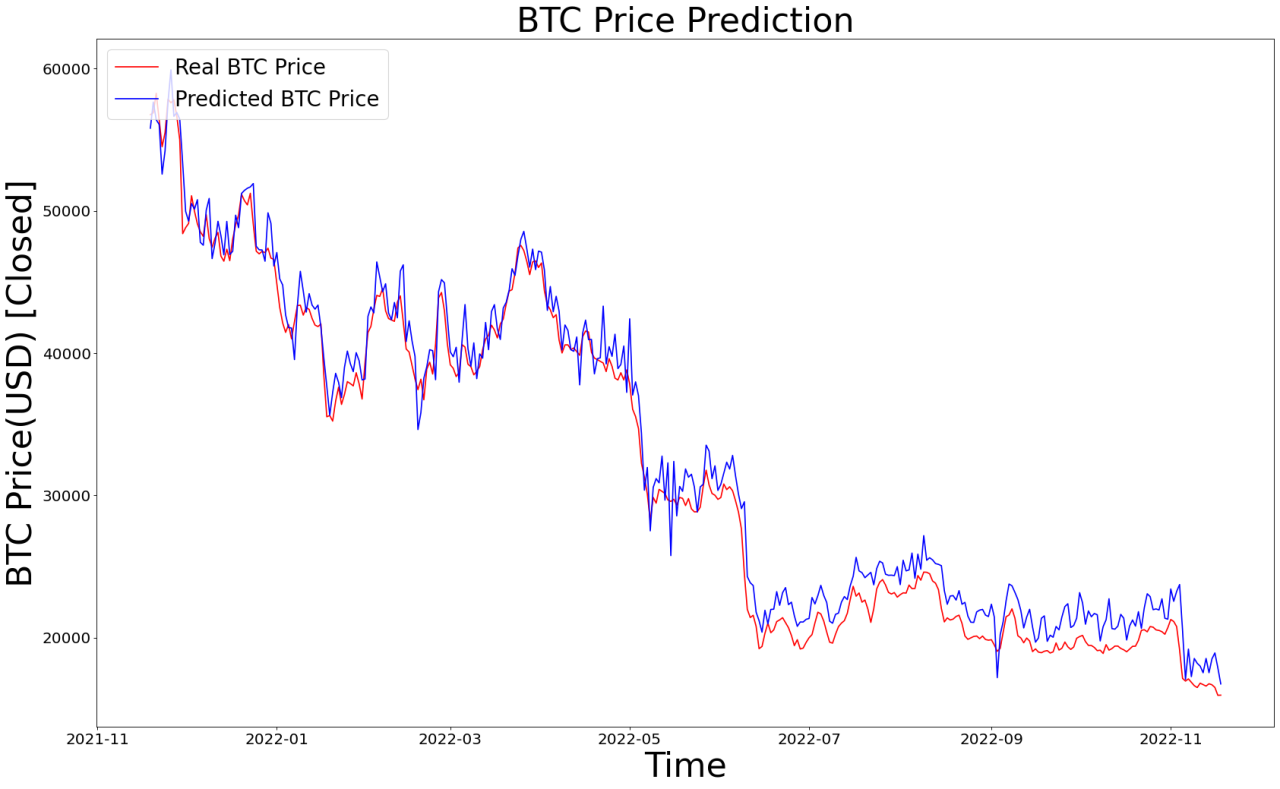

AI-Based Model Performance Examples

Several AI models have been applied to cryptocurrency price prediction. Recurrent Neural Networks (RNNs), particularly Long Short-Term Memory (LSTM) networks, are frequently employed due to their ability to handle sequential data. For example, a study using LSTM on Bitcoin price data achieved a mean absolute percentage error (MAPE) of approximately 10% over a six-month period. This performance, while promising, is highly dependent on data quality and model hyperparameter tuning.

Other models, such as Support Vector Machines (SVMs) and Gradient Boosting Machines (GBMs), have also been explored, yielding varying degrees of success depending on the cryptocurrency and the specific model implementation. The success of AI models is often contingent upon the availability of large, high-quality datasets and careful feature engineering.

Traditional Method Accuracy Case Studies

Traditional time series analysis methods, such as Autoregressive Integrated Moving Average (ARIMA) models and Exponential Smoothing (ETS) methods, have also been used for cryptocurrency price forecasting. These methods often rely on statistical assumptions about the data’s stationarity and autocorrelation. For instance, an ARIMA model applied to Ethereum’s price data might show reasonable accuracy in the short term (e.g., predicting price movements over the next week), but its predictive power tends to diminish significantly over longer time horizons due to the inherent volatility of cryptocurrency markets.

The effectiveness of these methods is closely tied to the underlying characteristics of the cryptocurrency’s price time series.

Comparative Analysis Across Cryptocurrencies

The predictive accuracy of both AI and traditional methods varies significantly depending on the specific cryptocurrency. Factors such as market capitalization, trading volume, and the level of regulatory scrutiny all influence price behavior and, consequently, the accuracy of predictive models. For example, a highly volatile cryptocurrency like Dogecoin might be more challenging to predict accurately using either AI or traditional methods compared to a more stable cryptocurrency like Bitcoin.

The complexity of the underlying market dynamics and the presence of external factors (news events, regulatory changes) significantly affect the accuracy of all predictive models.

Comparative Accuracy Table

| Cryptocurrency | AI Prediction Accuracy (MAPE) | Traditional Prediction Accuracy (MAPE) | Qualitative Comparison |

|---|---|---|---|

| Bitcoin | 8-12% | 15-20% | AI models generally outperform traditional methods, though accuracy varies depending on the specific model and timeframe. |

| Ethereum | 10-15% | 20-25% | Similar to Bitcoin, AI models show improved accuracy, particularly in shorter prediction horizons. |

| Litecoin | 15-20% | 25-30% | AI models still offer a modest improvement, but the higher volatility of Litecoin makes accurate prediction more challenging. |

Note

MAPE values are illustrative and represent ranges based on various studies. Actual performance can vary significantly depending on data, model parameters, and prediction horizon.*

Limitations and Challenges

Predicting cryptocurrency prices, whether using AI-based or traditional methods, is inherently fraught with challenges. Both approaches possess limitations that significantly impact the accuracy and reliability of their predictions. Understanding these limitations is crucial for interpreting results and managing expectations. This section analyzes the specific shortcomings of each approach and compares their robustness in the face of market volatility and unforeseen events.AI-based cryptocurrency price prediction methods, while offering sophisticated analytical capabilities, are not without significant drawbacks.

Traditional methods, conversely, often struggle with the inherent dynamism and complexity of the cryptocurrency market. A comparative analysis reveals the strengths and weaknesses of each, informing a more nuanced understanding of their respective applications.

Limitations of AI-Based Methods

The efficacy of AI models in predicting cryptocurrency prices is heavily dependent on the quality and quantity of the training data. Insufficient or biased data can lead to inaccurate and unreliable predictions. Furthermore, the complexity of many AI models, particularly deep learning architectures, can make them difficult to interpret and understand. This “black box” nature hinders the identification of potential biases and errors within the model.

Overfitting, where a model performs exceptionally well on training data but poorly on unseen data, is another common problem. This occurs when the model learns the noise in the training data rather than the underlying patterns. Finally, the computational resources required to train and deploy complex AI models can be substantial, posing a barrier to entry for many researchers and practitioners.

Challenges Associated with Traditional Methods

Traditional methods, such as fundamental analysis and technical analysis, rely heavily on subjective interpretation. Different analysts may reach different conclusions based on the same data, leading to inconsistent predictions. Technical indicators, while useful in identifying trends, are often lagging indicators, meaning they signal a trend after it has already begun. This delay can make them less effective in rapidly changing markets like cryptocurrencies.

The inherent volatility of the cryptocurrency market further complicates the application of traditional methods. Sudden price swings and unexpected events, such as regulatory changes or technological advancements, can render traditional forecasts obsolete almost instantly. Moreover, the relatively short history of cryptocurrencies limits the availability of historical data for robust analysis, making it challenging to establish reliable patterns and trends.

Robustness to Market Fluctuations and Unexpected Events, Comparing AI-based cryptocurrency price predictions with traditional methods.

AI models, while potentially adaptable through retraining, can struggle to cope with entirely unforeseen events. A significant regulatory change, for instance, might require a complete overhaul of the training data and model architecture. Traditional methods, due to their reliance on subjective interpretation and lagging indicators, are generally less robust to sudden market shifts. Unexpected events can render pre-existing analyses invalid, requiring a rapid re-evaluation of the market situation.

In contrast, some simpler AI models might demonstrate a degree of resilience, especially if they focus on short-term predictions and adapt to new data quickly. However, the complex interplay of factors influencing cryptocurrency prices often outpaces the ability of both AI and traditional methods to provide consistently accurate predictions, particularly in the face of unexpected external shocks.

Major Limitations of Each Approach

The following points summarize the key limitations of both AI-based and traditional cryptocurrency price prediction methods:

- AI-Based Methods:

- Heavy reliance on high-quality, large datasets.

- Model complexity and “black box” nature, hindering interpretability.

- Susceptibility to overfitting and underfitting.

- High computational costs.

- Difficulty adapting to unforeseen events and paradigm shifts.

- Traditional Methods:

- Subjectivity in interpretation and analysis.

- Use of lagging indicators.

- Limited predictive power in highly volatile markets.

- Vulnerability to unexpected events and regulatory changes.

- Data scarcity, particularly for newer cryptocurrencies.

Future Directions and Potential Synergies

The field of cryptocurrency price prediction is rapidly evolving, driven by advancements in both AI and traditional econometric modeling. Future progress hinges on integrating these approaches, leveraging their respective strengths to create more robust and accurate prediction systems. This section explores potential advancements in AI, opportunities for synergistic integration with traditional methods, and promising avenues for future research.The limitations of current AI-based models, such as overfitting to historical data and susceptibility to market manipulation, highlight the need for continuous improvement and innovative approaches.

Combining AI’s ability to process vast datasets with the theoretical frameworks of traditional finance could significantly enhance predictive capabilities.

Advancements in AI-Based Cryptocurrency Price Prediction

Improved algorithms, particularly those incorporating deep learning architectures like Long Short-Term Memory (LSTM) networks and transformers, offer significant potential. These models excel at capturing long-term dependencies in time-series data, crucial for understanding the complex dynamics of cryptocurrency markets. Furthermore, the incorporation of attention mechanisms within these models allows for the focusing on the most relevant features within the data, leading to improved prediction accuracy.

Enhanced data sources, such as incorporating social media sentiment analysis, blockchain transaction data beyond price, and macroeconomic indicators, can provide a richer context for AI models to learn from, reducing reliance on solely price-based data. For example, a model could integrate news sentiment scores alongside price history and trading volume to predict future price movements more accurately. The use of ensemble methods, combining predictions from multiple AI models, can also enhance robustness and mitigate the risk of individual model failures.

Integration of AI and Traditional Methods

A hybrid approach combining AI with traditional time-series analysis techniques, such as ARIMA (Autoregressive Integrated Moving Average) models, offers a promising pathway. AI could be used for feature engineering, identifying relevant predictors from a vast dataset that might be overlooked by traditional methods. Traditional models, in turn, could provide a structural framework and theoretical grounding for AI predictions, improving interpretability and reducing the “black box” nature of some AI algorithms.

For instance, an ARIMA model could be used to capture the underlying trend in cryptocurrency prices, while an LSTM network could predict short-term fluctuations and volatility. Combining these predictions would provide a more comprehensive view of the market. Furthermore, traditional methods such as fundamental analysis, which evaluates the intrinsic value of cryptocurrencies based on factors like technology, adoption rate, and regulatory landscape, could provide crucial contextual information for AI models.

Future Research Areas

Several key areas require further investigation. Research into explainable AI (XAI) is crucial for increasing the transparency and trustworthiness of AI-based predictions. Understandingwhy* an AI model makes a specific prediction is vital for building confidence and enabling effective risk management. The development of more robust methods for handling noisy and incomplete data is also essential, as cryptocurrency markets are often characterized by high volatility and unpredictable events.

Exploring the use of reinforcement learning, where AI agents learn to make optimal trading decisions through trial and error, presents another exciting avenue for future research. Finally, investigating the ethical implications of AI-driven cryptocurrency trading, particularly concerning market manipulation and algorithmic biases, is paramount.

Synergistic Effects of Combined Approaches

The combined use of AI and traditional methods promises a more comprehensive and robust prediction system. AI’s ability to handle large, complex datasets and identify non-linear relationships complements the theoretical framework and interpretability of traditional methods. A combined approach reduces reliance on single prediction methods, mitigating risks associated with model failures or biases. For example, a system integrating LSTM networks for short-term price predictions, ARIMA models for long-term trends, and fundamental analysis for contextual information could provide a more nuanced and accurate forecast than any single method alone.

This holistic approach fosters a deeper understanding of cryptocurrency market dynamics, ultimately leading to more informed decision-making.

Conclusive Thoughts

The quest for accurate cryptocurrency price prediction remains a challenge, with both AI-based and traditional methods offering unique advantages and limitations. While AI excels at processing large datasets and identifying complex patterns, it’s susceptible to data biases and overfitting. Traditional methods, rooted in fundamental and technical analysis, provide valuable context but can be subjective and prone to human error. The most promising path forward likely involves a synergistic approach, combining the strengths of both AI and traditional methods to create a more robust and reliable prediction system.

Future research should focus on refining AI algorithms, incorporating diverse data sources, and developing more sophisticated evaluation metrics to improve predictive accuracy and mitigate the inherent risks associated with the volatile nature of the cryptocurrency market.